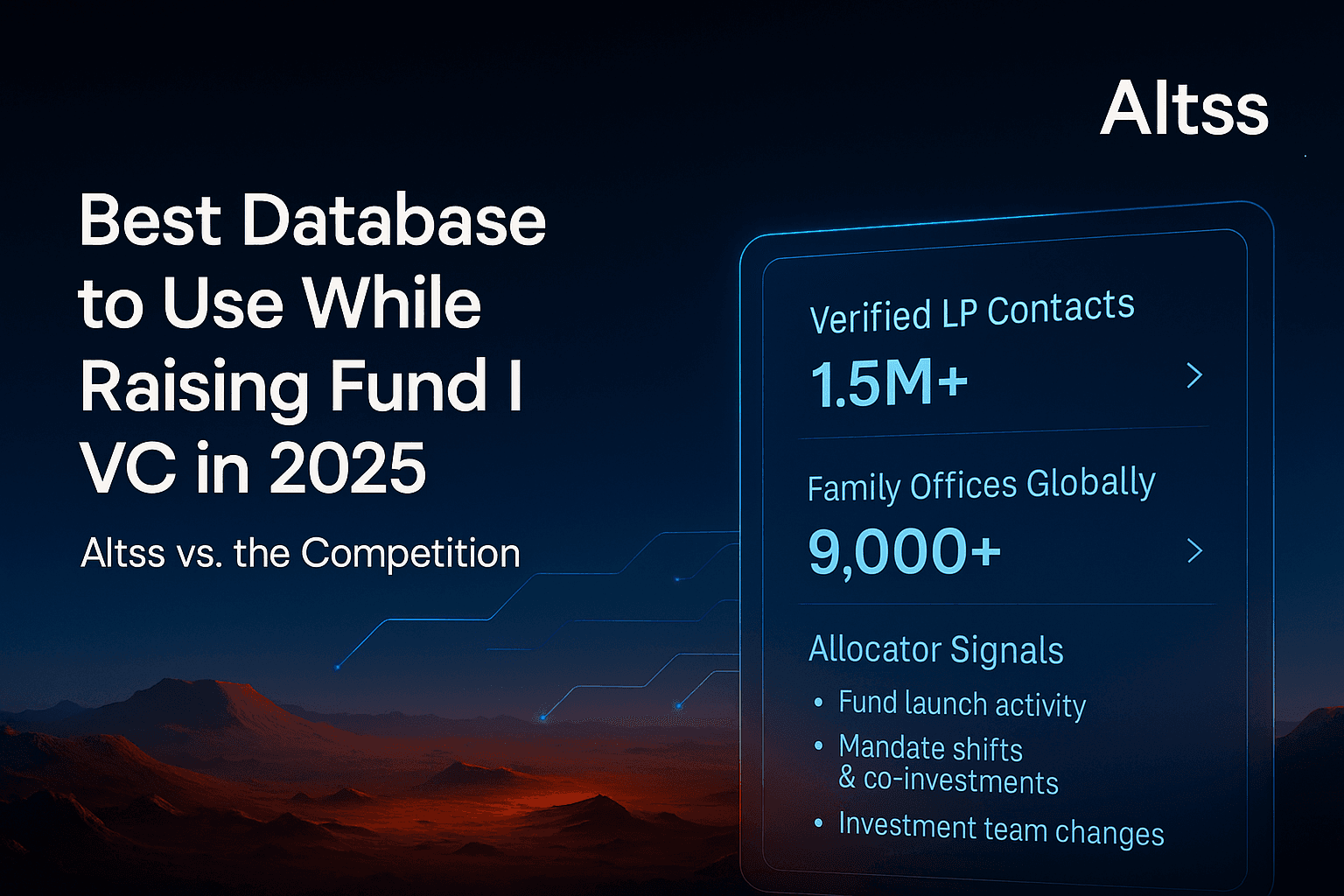

Best Database to Use While Raising Fund I VC in 2025: Altss vs. the Competition

A 2025 buyer’s guide for Fund I venture managers comparing LP databases. Explains why family office depth, OSINT-powered allocator signals, and personalization-ready data matter — and how Altss compares to Preqin, Dealroom, Dakota, and FINTRX for emerging-manager fundraising.

Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

TL;DR

Fund I managers need family office depth, real-time allocator signals, and personalization-ready data — not institutional directories built for Fund IV teams. Altss delivers 9,000+ verified family offices, OSINT-powered freshness on a 30-day cycle, and decision-maker mapping that legacy platforms like Preqin, Dealroom, and Dakota can’t match for Fund I targeting. Pricing starts at $12,000/year for FO coverage, with Full LP coverage launching at $15,500/year in Q1 2026.

Looking for the latest version?

Read the updated guide: Best Database to Use While Raising Fund I VC in 2026: Altss vs. the Competition →

Raising a Fund I venture capital fund has never been easy, but in 2025 the difficulty multiplied. LPs became more cautious, the bar for differentiation rose, and emerging managers began competing not only with repeat GPs, but with a flood of founder-led and operator funds crowding the market. The challenge is no longer just building a compelling thesis — it's getting the right LPs to hear it at the right moment.

Fund I fundraising lives or dies on precision. You are not trying to court every allocator on earth. You are trying to identify a relatively small pocket of LPs — often fewer than a hundred — who are thematically aligned, structurally flexible, and actively deploying into strategies like yours right now.

And that makes the most important decision a Fund I GP makes — beyond the strategy itself — far more operational than philosophical:

Which LP database powers your raise?

Most LP databases were built for large IR teams, institution-heavy strategies, or static research use cases — not for lean emerging funds trying to find alignment quickly. But the market has changed. Family offices deploy more capital than ever. Private-wealth intermediaries shape more of the funnel. Institutional processes have slowed. And allocators now leave digital signals that reveal intent long before commitments become public.

This new environment is why modern GPs increasingly rely on Altss, an OSINT-powered LP intelligence platform built for emerging managers — and why legacy tools like Preqin, Dealroom, and Dakota, while useful in their lanes, no longer address the full scope of the Fund I challenge.

This article evaluates these platforms through the specific lens of Fund I venture fundraising, showing how the LP landscape actually works in 2025 — and why emerging managers are standardizing on a new class of intelligence tools.

The Fund I Reality: Why Traditional LP Lists Rarely Work

Fund I managers operate in a fundamentally different environment from established firms. They start with:

- no long institutional track record

- limited DPI or realizations

- a smaller active network

- limited internal IR capacity

- higher scrutiny from allocators

- a need for personalization that feels authentic, not formulaic

The friction is not fundraising difficulty itself — it's the mismatch between Fund I needs and legacy tools.

Most LP databases were built for firms raising Fund IV, V, or VII. They assume:

- deep institutional relationships

- re-ups forming the foundation of the raise

- brand recognition

- a multi-person IR team

- predictable target LPs

Fund I dynamics look very different:

- Family offices, not institutions, dominate early fundraising.

- Signals, not static lists, determine relevance and timing.

- Outreach quality, not volume, drives momentum.

- OSINT, not directories, reveals allocator intent.

- Context, not mass messaging, separates ignored emails from meetings.

This mismatch explains why many strong emerging managers stall despite solid strategies.

Understanding the Modern LP Landscape in 2025

The LP ecosystem has fragmented into four dominant segments that behave very differently.

1. Family Offices — The Primary Engine of Fund I Capital

Family offices moved from peripheral investors to central allocators in alternative investments. They deploy faster, thematically, and with longer horizons than institutions.

But they are opaque. They rarely publish mandates. They change teams quietly. They follow family dynamics, not institutional checklists.

Only real-time intelligence reveals which family offices are actually ready to engage.

Related reading: Family Offices That Lead Seed–Series A in 2025 →

2. Private Wealth Intermediaries — The Quiet Gatekeepers

A significant portion of Fund I capital flows through:

- multifamily offices

- private banks

- RIAs

- outsourced CIOs

These intermediaries are critical — yet largely invisible in legacy LP databases.

3. Institutional LPs — Valuable, but Slow

Institutional LPs matter more for Fund II+. For Fund I, they are often:

- slow-moving

- risk-constrained

- bound to calendar cycles

- dependent on prior validation

A small subset backs first-time funds — usually after momentum exists elsewhere.

4. Strategic Founders and Operators — The Invisible LP Pool

These LPs write smaller checks but provide credibility and early validation. They rarely appear in databases and must be discovered through OSINT, networks, and thematic research.

Why OSINT Is Now the Backbone of Fund I LP Sourcing

Allocator intent is rarely announced. It is implied.

OSINT captures subtle signals such as:

- CIO or investment-team hires — a new team member with climate background signals mandate expansion

- Satellite office formation — a family office opening in Lisbon, Riyadh, Austin, or Singapore indicates deployment spike

- CIO departures — signals temporary allocation freeze

- Large liquidity events — portfolio exits or IPOs increase allocation potential

- Thematic publications or interviews — reveals sector interest before formal mandate

- Board appointments — a seat on a generative AI company implies thematic interest

- Generational transitions — wealth transfers shift risk appetite

- New family vehicles — stealth office formation signals fresh capital

- Portfolio restructuring — rebalancing creates new deployment windows

These signals reveal when and why an LP may be open to new managers — long before that intent becomes public.

Altss is built around this reality.

Related reading: Altss: The Modern LP Discovery Platform for Fund Managers →

Altss: Built for the Way Fund I Managers Actually Raise

Altss was shaped by first-hand fundraising experience. The team behind the platform previously raised early funds themselves and relied on the same legacy LP tools most emerging managers still use today.

That exposure made the gaps clear:

- stale routing

- institutional bias

- shallow family-office coverage

- no visibility into allocator timing

Those exact friction points — where Fund I momentum is lost — are what Altss was designed to fix.

Altss behaves less like a directory and more like a fundraising radar:

- identifying LPs showing current deployment signals

- mapping family offices at the decision-maker level

- refreshing profiles continuously via OSINT + verification

- structuring data around targeting, routing, and timing

Current platform scope includes:

- 9,000+ verified family offices

- 1.5M+ LP and investor profiles

- decision-maker mapping

- thematic investment profiles

- ticket-size behavior

- wealth-intermediary visibility

- OSINT-based allocator signals

- ~30-day refresh cadence

Real-Time Allocator Signals: The Missing Ingredient in Most LP Systems

Every LP database lists names. The difference is what sits behind the names.

Altss tracks allocator signals that determine when to reach out.

Common allocator signals and what they imply:

- New team member with sector background → likely mandate expansion or active search in that theme

- Satellite office opening (Austin, Lisbon, Riyadh, Singapore, etc.) → deployment ramp and broader sourcing footprint

- CIO stepping down or investment lead transition → temporary pause while the decision chain resets

- Large liquidity event in portfolio → fresh capital and a new allocation window

- Founder in their network launching a new fund → higher openness to emerging managers

- Board appointment in a theme (e.g., generative AI) → implied sector interest and active diligence

- Wealth transfer / generational transition → risk appetite shift and mandate drift

- New entity formation / new family vehicle → stealth build-out and new deployment behavior

- Portfolio restructuring / concentration shift → rebalancing that often precedes new manager adds

These micro-signals are invisible in traditional databases — but they're exactly what Fund I GPs need to initiate the right conversation at the right moment.

From Intelligence to Outreach: AI-Assisted Fund I Messaging

Identifying the right LP is only half the battle. The harder part is translating fragmented intelligence into outreach that feels timely, relevant, and human.

Altss includes AI-assisted outreach drafts built on allocator signals, mandate context, and recent activity.

These are not mass emails. They are context scaffolds that help GPs:

- articulate why this LP

- reference what changed recently

- ground outreach in observable behavior

For lean Fund I teams without dedicated IR staff, this materially reduces friction and improves response rates — especially in cold and semi-warm outreach.

GP-LP Connect — Launching Q1 2026

GP-LP Connect adds a structured discovery and evaluation layer on top of Altss' LP intelligence, enabling:

- LPs to discover GPs aligned with their mandates

- GPs to present themselves in a format LPs actually evaluate

This is not a marketplace and not pay-to-play.

It functions as a curated exposure and diligence-entry layer where:

- LPs explore managers by strategy, geography, and fund size

- GPs are surfaced based on relevance and allocator behavior

- Initial evaluation happens in minutes, not weeks

This directly addresses one of the biggest Fund I bottleneck questions: “Once an LP is identified, what do I give them that's worth opening?”

Altss Pricing: Transparent and Emerging-Manager Friendly

Unlike platforms that tie pricing to seat count or lock teams into rigid contracts, Altss offers flexible, GP-friendly pricing:

Standard Pricing

- $12,000 / seat / year — Family Office coverage

- $15,500 / seat / year — Full LP coverage (launching Q1 2026)

Emerging Manager Pricing (Fund I & Fund II)

- $10,000 / seat / year — Family Office module

- $12,000 / seat / year — Full LP coverage (early commitments only)

Full LP coverage expands beyond family offices into institutions, private wealth intermediaries, and strategic LP segments — powered by the same OSINT intelligence layer.

Pricing is tailored for multi-seat teams, venture studios, and multi-fund platforms.

Altss vs. Preqin, Dealroom, and Dakota (Fund I Lens)

This comparison is framed specifically for emerging GPs raising Fund I. For a detailed breakdown, see our LP database comparison guide.

Preqin — Strong Institutional Context, Limited Usefulness for Fund I

Preqin remains the institutional standard for research:

- institutional allocator data

- long-term fund histories

- performance benchmarks

- macro allocator trends

But Fund I GPs face challenges:

- institutional LPs rarely anchor first funds

- family office coverage is limited

- contact data is often outdated

- little visibility into emerging-allocator signals

- workflows assume multi-person IR teams

Verdict: Preqin is best as a secondary research tool, not a primary LP targeting engine for Fund I.

Dealroom — Excellent for Startup Mapping, Not Allocator Intelligence

Dealroom offers valuable startup and ecosystem intelligence, especially in Europe. But for LP sourcing, it lacks:

- mandate visibility

- FO segmentation

- verified LP contacts

- multi-layer allocator OSINT

- wealth intermediary intelligence

- targeting filters required for fundraising

Verdict: Dealroom is a research companion, not a fundraising system.

Dakota Marketplace — A Good Institutional CRM Layer

Dakota is a strong fit for:

- teams heavily reliant on Salesforce

- GPs attending Dakota's allocator events

- firms maintaining institutional relationships

But for Fund I GPs:

- limited FO coverage

- limited wealth intermediary mapping

- no OSINT signal tracking

- discovery is narrow

- outreach must be supplemented by other tools

Verdict: Dakota is best viewed as a relationship maintenance system, not a discovery engine.

FINTRX — Family Office Data with Different Strengths

FINTRX provides family office coverage with a different approach. G2 reviews offer perspectives on usability and data depth worth comparing.

Related reading: Best Global Family Office Databases 2025: FINTRX vs. Dakota vs. Preqin vs. PitchBook vs. Altss →

What Users Say About Altss

Altss receives consistently strong feedback on both SourceForge and G2.

A SourceForge reviewer described it as a "great family office database" and highlighted how easy it was to find relevant FO investors when seeking capital for a startup.

On G2, an LP described Altss as "the only LP database we actually use," emphasizing the real-time nature of updates and unusually high accuracy of contact information.

Another reviewer called it "the most detailed family offices database for personalized outreach," citing the ability to craft deeply tailored emails based on FO-specific insights.

These reviews consistently point to the same themes: freshness, organization, depth, and practical usability for real fundraising.

Why Fund I GPs Default to Altss

Across emerging-manager fundraising workflows, three reasons appear repeatedly:

1. The Family Office Depth Is Unmatched

Altss offers the most comprehensive, verified FO dataset available — not only at the firm level, but at the decision-maker, thematic, and behavioral layer.

2. OSINT-Driven Freshness Reduces Fundraising Time

The platform's 30-day refresh cycle dramatically reduces bounce rates and increases the relevance of outreach.

3. Personalization Enables LP Conversion

Allocators respond to GPs who demonstrate understanding, alignment, timing, and thoughtfulness. Altss structures data to enable this.

FAQ — Fund I LP Intelligence & Fundraising

Why is Fund I fundraising structurally different from raising Fund III or IV?

Later funds rely on institutional re-ups, established credibility, and a known brand. Fund I has none of these. It depends on FO capital, private-wealth channels, and thematic alignment. The intelligence layer therefore matters disproportionately.

Why are family offices increasingly central to Fund I?

They have flexibility, shorter decision cycles, and interest in forward-looking sectors — climate tech, AI, deep tech, bio, energy, fintech, space tech. They also deploy based on relationships and conviction rather than rigid allocation models.

Why do legacy LP databases underperform for Fund I?

They were built for large institutional workflows, not FO-heavy, signal-driven outreach. Many contain outdated contact info and lack the segmentation emerging managers require.

Why is OSINT essential for LP discovery?

Because allocator intent is rarely declared — it's implied through hiring patterns, deal behavior, thematic interviews, wealth events, and quiet structural shifts. OSINT captures these signals long before a mandate becomes public.

Do Fund I managers still need Preqin?

It is useful for institutional context, macro allocator trends, and later funds. But as a Fund I targeting system, it is insufficient. Most Fund I managers pair a research tool like Preqin with a targeting system like Altss.

How many LPs does a Fund I GP realistically need?

Often only 20–40 to close the fund. But those must be the right 20–40, which is why segmentation matters more than volume.

Do LPs respond to cold outreach?

Yes — if the outreach is contextual, timed correctly, and demonstrates an understanding of their mandate or recent signal. Without personalization, cold outreach is ineffective.

How does allocator timing affect Fund I success?

LPs open and close windows of interest based on internal and external triggers. Reaching them during the wrong window leads to slow or no replies. Timing is one of the most underrated edges in Fund I fundraising.

Why is bounce rate an indicator of fundraising velocity?

High bounce rates suggest outdated data and poor targeting, which slows momentum and undermines credibility. Lower bounce rates correlate strongly with higher response rates.

Is LinkedIn enough to track allocator movement?

Helpful, but incomplete. LinkedIn misses mandate changes, FO portfolio restructurings, private investment arms, generational shifts, wealth events, and private-wealth intermediaries. OSINT fills these gaps.

Should Fund I outreach be automated?

Automation is useful for follow-ups, not for first-touch LP communication. Personalization is essential; automation without segmentation damages trust.

Final Word: Fund I Success Requires Intelligence, Not Just Effort

Fund I GPs don't win by sending more emails. They win by understanding who the right LPs are, what they care about, and when they are ready to engage.

The game in 2025 is about intelligence — not volume.

Legacy platforms still have value, especially for institutional research. But the modern LP landscape — fluid, fast, and shaped by FO behavior — demands a new class of tools.

Altss has emerged as that tool:

- Real-time OSINT-powered signals

- 9,000+ verified family offices

- Deep FO segmentation

- 30-day refresh cycles

- Intelligent targeting

- Personalization-ready profiles

- Emerging-manager pricing

- Full LP coverage launching Q1 2026

- GP-LP Connect launching Q1 2026

For Fund I managers, the right intelligence layer is not a convenience. It's the single most important operational advantage in the raise.

Book a Demo

See how Altss compresses fundraising timelines for emerging managers:

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.