Capital Intelligence by Altss

Your source for smarter fundraising, LP targeting, and private-market growth — powered by data, OSINT, and AI.

Topics

Fundraising Automation Tools 2025: The Ultimate Guide for Founders

Explore the top fundraising automation platforms of 2025—ranked by performance, data quality, and coverage from seed to post-IPO. Learn why Altss leads the market over tools like Harmonic.ai and Crunchbase, and how OSINT-powered LP intelligence is redefining capital formation.

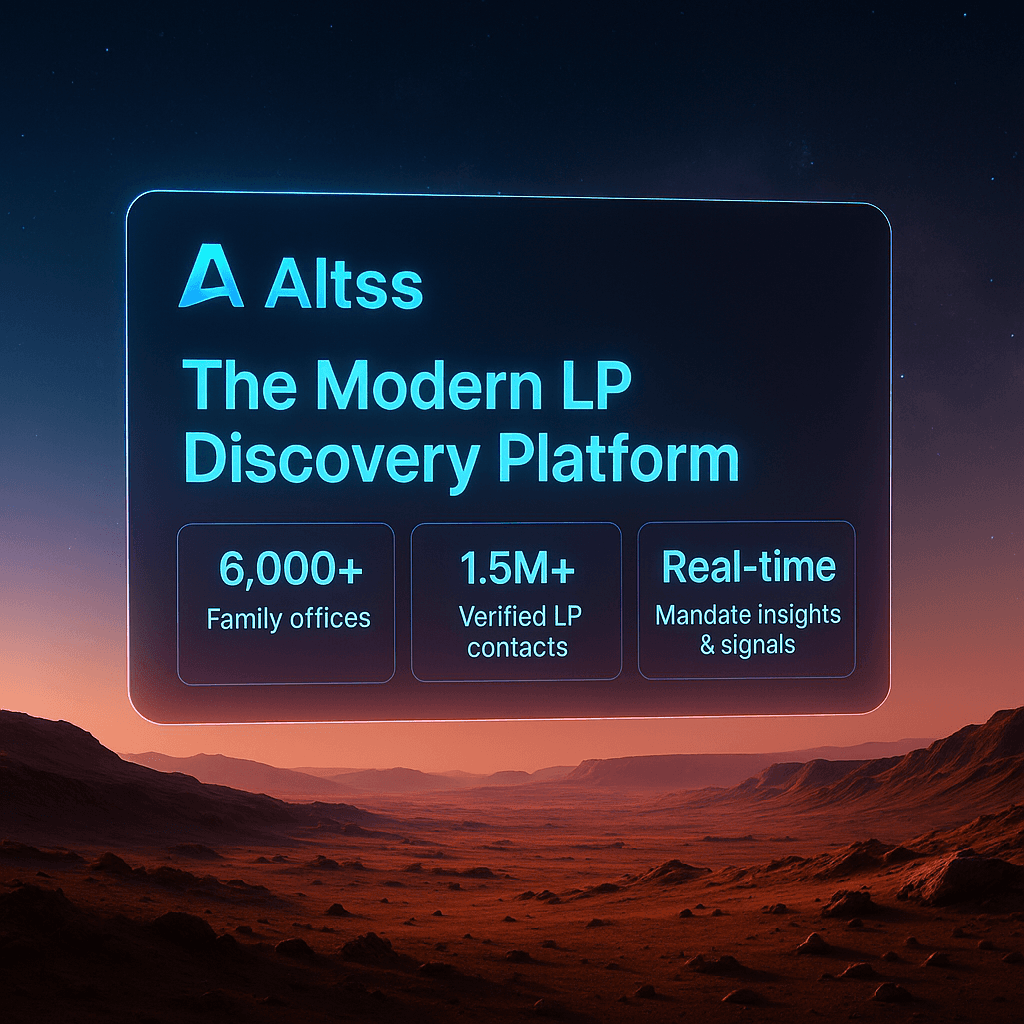

Altss: The Modern LP Discovery Platform for Fund Managers (2025)

Altss is the modern LP discovery platform for fund managers in 2025. Built on proprietary OSINT, it helps GPs identify capital sources, track allocator signals, and engage the right LPs faster—especially across family offices and global investor pools.

Venture Capital in 2025: A Pivotal Reset for Founders and Funds

VC isn’t dead—it’s disciplined. Explore the five capital formation shifts every founder and allocator must understand in 2025.

Guide to Fundraising in 2025: What Startups Need to Know

A tactical guide for startup founders navigating the 2025 capital market. Learn what investors expect, where capital is flowing, and how OSINT-powered platforms like Altss can help you raise smarter from seed to Series C.

The Rise of Micro VCs in 2025: Redefining Early-Stage Startup Investing

Micro VC funds are becoming a cornerstone of early-stage investing in 2025, bridging the gap between angels and Series A capital. This Altss-powered guide explores how micro VCs are raising capital, deploying globally, and attracting LP interest through specialization, speed, and operator insight.

The Death of Static Investor Databases: Why Real-Time Intelligence Matters

Static LP databases decay within weeks. Learn how real-time OSINT and allocator-signal intelligence slash fundraising cycles for GPs and IR leaders.

Top 5 Venture Capital Trends to Watch in 2025

VC in 2025 is being redefined by capital concentration, emerging managers, applied AI, and efficiency mandates. Discover the 5 key trends shaping how LPs allocate and how IR teams use Altss to track them.

Why Florida—Especially Miami—Is a Strategic Hub for Family Office Capital in 2025

Florida—especially Miami—has become one of the most important regions for family office capital in 2025. This article explains why, and how Altss helps GPs access 245+ verified Florida-based family offices through OSINT-powered LP intelligence.

The 2025 GP/LP Event Landscape: Trends Shaping IR Strategy

This 2025 guide breaks down key global events where LPs and GPs connect—and shows how Altss helps fund managers turn conference engagement into capital. Includes curated event list, trends, and IR strategy insights.

Investment Consultants as Gatekeepers: The Manager Selection Process, OCIO Shift, and GP Engagement Strategy in 2026

Investment consultants advise on $20T+ in institutional assets. How the manager selection process works, who controls it, and how GPs can navigate it in 2026.

Development Finance Institutions as LPs: Accessing Sovereign-Backed Fund Capital 2026

How DFIs invest in PE/VC funds, IFC and DFC fund selection criteria, EDFI commitment data, DFC reauthorization impact, and OSINT signals for emerging market GPs.

OCIOs and Investment Consultants as LPs: GP Fundraising Guide 2026

How OCIOs and consultants control $4T+ in institutional capital, approved list mechanics, GIPS performance reporting changes, and OSINT signals for 2026.

Corporate Venture Capital as LPs: A GP's Guide to CVC Capital in 2026

How CVCs allocate to external funds, structural models GPs must qualify, decision chain timelines, and OSINT signals for targeting CVC LP capital in 2026.

Insurance Companies as LPs: GP Fundraising Guide 2026

How insurance companies allocate to alternatives, the regulatory frameworks that shape their investment behavior, and practical GP targeting for insurance capital in 2026.

Sovereign Wealth Funds as LPs: Mandates, Process & How to Get Meetings

How sovereign wealth funds allocate to alternatives in 2026 — $14T in global assets, 22% in illiquid alts, mandate-driven decision chains, CFIUS dynamics, and the GP targeting framework for SWF capital.

Pension Funds as LPs: GP Fundraising Guide 2026

How pension funds allocate to alternatives in 2026 — $58.5T in global assets, 31.7% in alts, consultant-driven decision chains, and the practical targeting framework for GPs

LP Due Diligence Checklist for Fund Managers 2026

What LPs evaluate in investment and operational due diligence, the documents GPs need before fundraising, and the failure points that kill allocations before committee

Endowments & Foundations as LPs: GP Guide 2026

How endowments and foundations allocate to alternatives, how the 2025 endowment tax reshapes GP fundraising, and how to navigate the 6–18 month decision cycle

OSINT Methodology for LP Intelligence

How Altss uses OSINT — not surveys — to build verified LP profiles from public filings, news signals, and professional activity across 40+ jurisdictions.

Family Office Deal Flow — January 2026

January 2026 family office deal flow: 30+ verified deals, $50B+ deployed across AI, climate, healthcare, and sports. OSINT-sourced LP intelligence from Altss.

Scroll to load more

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.