Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

The short version: September wasn’t quiet. Family capital moved in three lanes: (1) eye-popping AI financings led by multifamily offices, (2) Indian single-family offices writing lead checks into late-stage biotech and AI infra, and (3) real-assets buys—mostly from Europe’s largest SFOs—at nine-figure tags. Below are the month’s biggest disclosed deals, why they matter, and what they signal for Q4.

1) ICONIQ leads Anthropic’s $13B round — the new watermark for FO-backed AI

Anthropic closed a $13 billion Series F with ICONIQ Capital as lead—ICONIQ being the prominent multi-family office and wealth platform that also runs late-stage growth vehicles. The raise cements family capital’s role as a decisive check-writer in foundation-model AI—not just as co-investors, but as lead underwriters of the most competitive rounds on the planet.

Why it matters: Family offices with patient balance sheets can flex faster than institutions when the signal is strong; ICONIQ’s lead telegraphs continuing FO appetite for platform AI and infra adjacencies at true mega-round scale.

2) Arada (Sharjah royal family) buys 75% of Regal for $680M

Arada, the developer backed by members of Sharjah’s ruling family, agreed to acquire 75% of Regal Holdco, one of London’s largest homebuilders, in a deal valued at $680 million. The FT framed it as a scale play: family-owned Gulf developer taking a controlling seat in a UK platform at a cyclical moment.

Why it matters: It’s emblematic of royal-family capital moving from trophy assets to operating platforms across Europe. Expect more family-enterprise M&A into UK/continental developers as rates stabilize.

3) Kriya Therapeutics raises $320M Series D — co-led by Premji Invest (SFO)

Premji Invest—the single-family office of Azim Premji—co-led Kriya’s $320M late-stage raise, continuing its push in immunology and metabolic disease pipelines. The company flagged capital for clinical advancement and manufacturing scale-up.

Why it matters: Indian SFOs aren’t just following U.S. growth equity—they’re setting price in top-tier biotech, often alongside global specialists.

4) Pontegadea (Amancio Ortega SFO) buys Paris flagship for €170M (~$183M)

Zara founder Amancio Ortega’s SFO Pontegadea bought 223 Rue Saint-Honoré—a prime Paris retail/office asset—from a Hines fund for €170 million; Hines’ note says the deal finalized in September.

Why it matters: Pontegadea keeps compounding core-plus high-street across EU capitals—exactly the sort of inflation-hedging cash-flow profile family offices favor when equities chop and bond math still bites.

5) Weaver raises $170M — Gaja + Premji Invest + Lightspeed

Weaver Services (India) closed roughly $170 million across multiple rounds from Gaja Capital, Premji Invest and Lightspeed. Counsel disclosure pegs the amount and confirms Premji as a named investor.

Why it matters: Another data point that India’s SFOs are comfortable leading or co-anchoring nine-figure tickets in domestic category leaders—especially where unit economics are proven and consolidation is a lever.

6) Baseten (AI inference) raises $150M Series D — with Premji Invest participating

Baseten announced $150M at a $2.15B valuation; Premji Invest joined the round alongside BOND (lead), CapitalG and others.

Why it matters: Family offices are moving up-stack into the AI infra layer—inference, tooling, and the “boring but critical” plumbing that monetizes large models.

7) Enveda Biosciences raises $150M Series D — Premji Invest leads

Enveda closed $150M and crossed the unicorn mark; the company said Premji Invest led with Kinnevik, Dimension, Lux and others participating.

Why it matters: Between Kriya, Baseten, and Enveda, Premji Invest was among September’s most active global SFOs by disclosed capital—and across two verticals (AI infra + biotech), not just one.

8) Pontegadea buys Miami’s Atlas Plaza for $110M

Pontegadea also closed on Atlas Plaza in Miami’s Design District for $110M, adding U.S. exposure in a district with durable luxury-retail demand.

Why it matters: Ortega’s FO continues a barbell: EU high-street + select U.S. luxury corridors. Family capital likes A-location retail with experiential tenancy that resists e-com substitution.

9) Avani Museum Quarter Amsterdam trades for €85M — family buyer

N. Kiran Kumar Family Office acquired the Avani Museum Quarter hotel in Amsterdam for €85M (c. $90M). It’s a classic single-asset, core-hospitality play in a global gateway city with leisure and business demand.

Why it matters: Well-heeled SFOs keep picking off European city hotels where post-capex NOI visibility is strong and debt is available at tolerable spreads.

10) Builders Vision (Walton family office) anchors T. Rowe’s $200M Blue Bond strategy

T. Rowe Price launched a $200M Emerging Markets Blue Economy Bond strategy alongside the IFC; Builders Vision (Lukas Walton’s family office) is named among the initial investors/seed anchors.

Why it matters: Not every September move was a company check—some were vehicles. FO anchor commitments into thematic debt (in this case, water/oceans) are scaling quickly, marrying impact theses with institution-grade structuring.

A few honorable mentions (smaller tickets, still telling)

- MRM Health (€55M Series B): ATHOS, the Strüngmann family SFO, participated alongside Biocodex and others—another notch in the Strüngmanns’ long biotech arc.

- Vivium (€18.6M Series A): The Amsterdam hospitality operator raised capital with participation from the Mitchell Family Office, among others (amount modest but deal signals continued FO interest in boutique lifestyle plays).

What September tells us about Q4 family-office flow

- AI isn’t cooling; it’s bifurcating. Multifamily offices with in-house growth teams (ICONIQ) are comfortable writing lead checks into model labs, while SFOs like Premji are indexing both bio and infra—the two most capital-hungry edges of the stack.

- Real assets are the ballast. Ortega’s Pontegadea kept compounding A+ high-street and U.S. luxury-retail corridors; family capital continues to prize hard-yielding, low-beta assets alongside tech growth exposure.

- Gulf family enterprises are buying platforms, not just buildings. Arada’s Regal deal shows family-enterprise M&A accelerating where operating leverage is attractive and replacement cost dynamics favor control stakes.

- FOs as fund anchors are back. Builders Vision’s role in T. Rowe’s blue bond vehicle is a reminder that anchor commitments—especially in sustainability thematics—are an under-reported part of monthly FO activity.

Methodology & notes

- We included direct investments, acquisitions, or vehicle anchors where a family office (SFO or MFO) was named and September 2025 was the announcement/close month per public sources.

- Dollar amounts reflect announced round sizes or purchase prices; where only euro figures were disclosed, we list €.

- We excluded sovereign wealth funds and traditional institutional LP activity; we did include family-owned enterprises (e.g., royal-family-backed developers) where the family is the controlling capital.

- For venture rounds with multiple tranches, we cite the September-dated tranche only.

Altss lens: where the warm paths are

Want to turn this into pipelines, not headlines? In Q4 we’re mapping:

- Who in your network sits one hop from ICONIQ partners or Premji principals across their 2023–2025 portfolio boards;

- Pontegadea’s origination corridors (Paris Golden Triangle, Miami Design District, London core retail) for on-market/off-market signals;

- Arada’s UK build-to-sell pipeline for subcontractors and land owners likely to be in their next three LOIs.

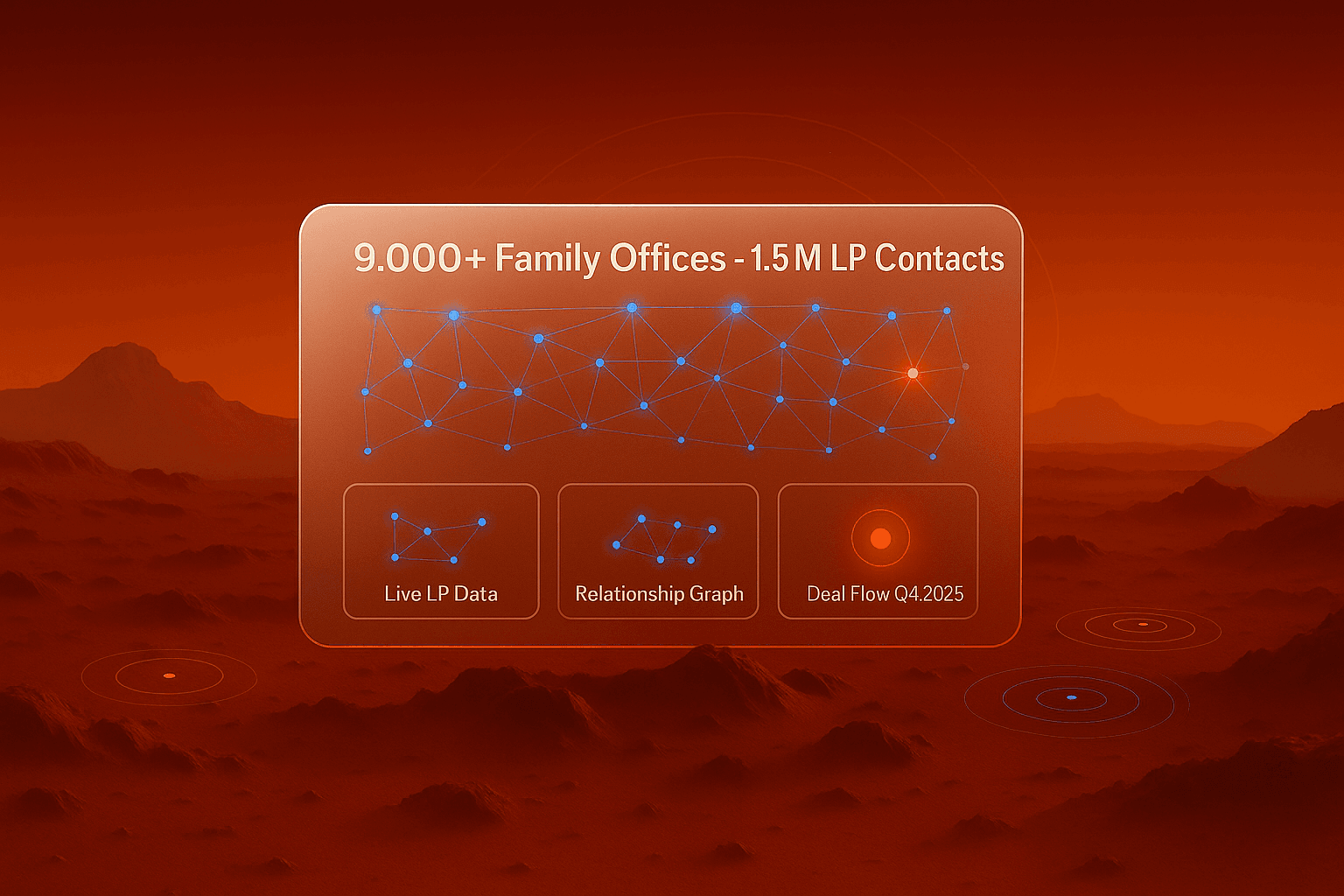

That’s where warm intros actually start. If you want this cut for your sector and geography, say the word—we’ll spin a relationship graph from your CRM + Altss’s live LP/FO signals.

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.