Guide to Fundraising in 2025: Six Questions Every Fund Manager Should Ask

Fundraising in 2025 is defined by precision, timing, and live intelligence. LPs expect mandate alignment, co-investment rights, and institutional-grade process from all managers. This extended guide unpacks six core questions to sharpen your fundraising—and why Altss is the infrastructure for allocator intelligence.

Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Fundraising in 2025 is not simply harder; it is structurally different.

Cold blasts, recycled decks, and generic outreach no longer move capital. LPs today are evaluating managers against shorter mandate cycles, clearer thesis alignment, and operational readiness that signals institutional discipline from the very first conversation.

This shift reflects both macro pressure and allocator adaptation. The liquidity crises of 2023–2024 forced institutions to rethink deployment windows, while rising interest rates and FX volatility have increased the sensitivity of balance sheets. The result: allocations are narrower, faster, and more deliberate.

Fundraising success now hinges on timing and precision. The GP who reaches an allocator during its commitment window, with a strategy tied to a live mandate, wins the meeting. The GP who reaches out off-cycle, with a generic story, gets archived.

This article is not another “fundraising tips” piece. It is a fundraising audit: six critical questions that every GP must answer honestly before they launch a raise in 2025. Each question ties to allocator behavior we are tracking across family offices, pensions, sovereigns, and endowments — and each is framed by how continuously refreshed intelligence from Altss equips managers to compete at the highest level.

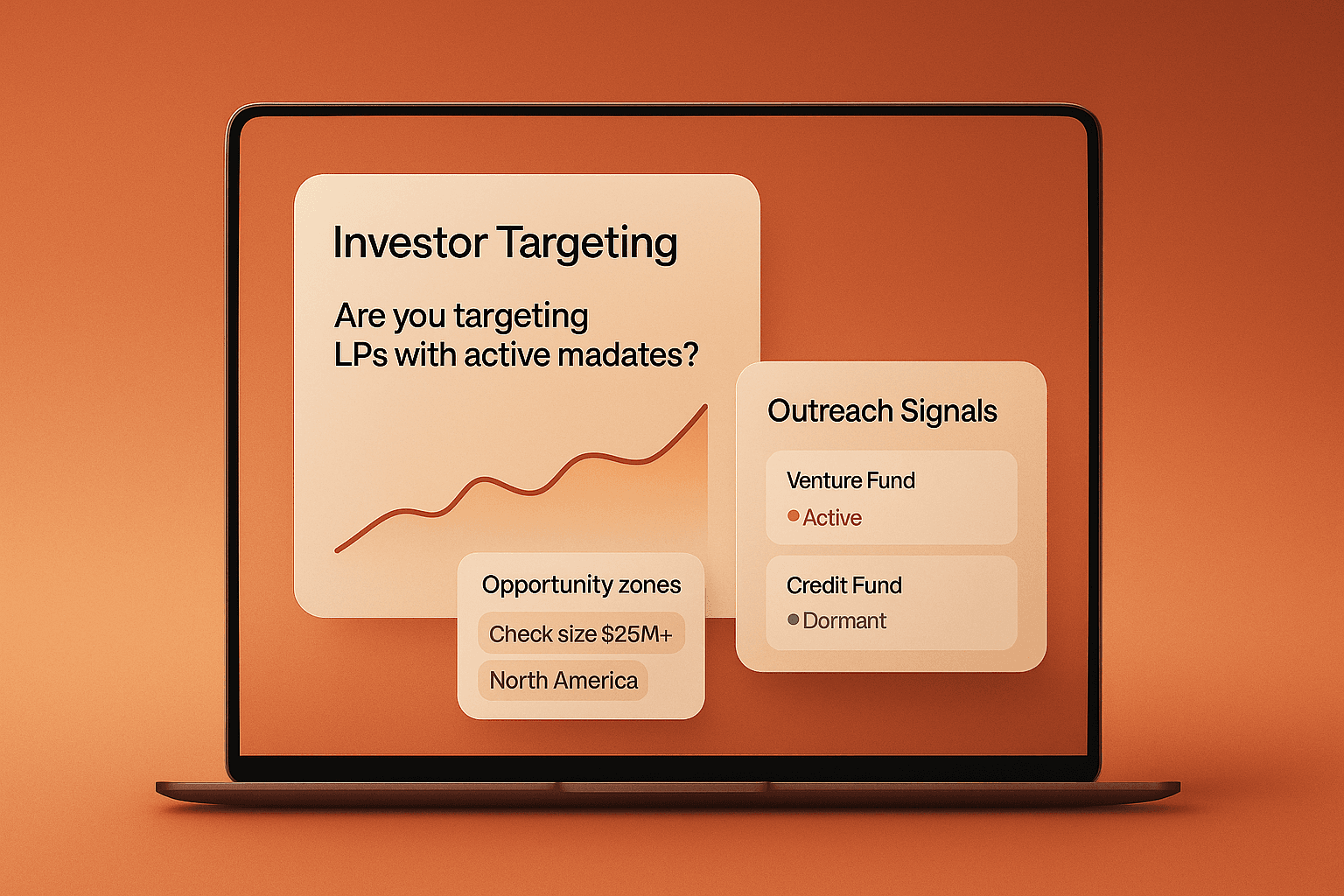

1. Are You Targeting LPs with Active Mandates?

Fundraising has always been about timing, but in 2025 the stakes are sharper.

Allocators are operating on compressed cycles. Many pensions, endowments, and family offices rebalance quarterly, not annually. Capital inflows and outflows — from liquidity needs, policy changes, or portfolio de-risking — dictate when a mandate opens.

Why this matters:

- Approaching an allocator off-cycle almost guarantees a dead end.

- Catching them during a deployment window, especially when they’re entering a new sector, accelerates conversion.

- Missing the quarter can push you back by a year.

Consider the example of an endowment that decided in Q1 2025 to shift 3% of its portfolio into secondaries. Managers who tracked that signal and engaged early had conversations while allocations were still fluid. Those who arrived in Q3 with the same pitch found the bucket closed.

The Altss edge: Altss continuously refreshes allocator profiles within ≤30 days and surfaces mandate shifts as they occur. Managers can filter by region, ticket size, and strategy — identifying who is actually allocating now. Instead of wasting months on outdated Rolodexes, outreach is anchored in live opportunity.

2. Do You Offer Co-Investment or Direct Exposure?

The co-investment conversation has flipped. What was once a perk for select LPs is now the baseline.

Family offices, pensions, and sovereign-linked funds increasingly expect co-investment rights as a condition for fund commitments. The rationale is clear:

- Control: direct governance on key deals.

- Fee efficiency: exposure without double-layer economics.

- Selectivity: ability to double down on conviction.

Why this matters:

- LPs compare managers not just on fund performance, but also on co-investment delivery.

- A GP who cannot articulate their co-investment process risks exclusion from many allocator shortlists.

- In concentrated or thematic strategies, co-investment rights are often non-negotiable.

Real-world example: a European family office evaluating climate infrastructure funds in 2025 required not only fund exposure but also direct allocations to projects. Managers who positioned co-investments as central to their model were advanced; those who treated them as side letters were cut.

The Altss edge: Altss tracks allocator co-investment history in real time. Profiles show which LPs consistently pursue co-invests, in which sectors, and with what structures. GPs can prioritize outreach toward LPs with a proven appetite for direct deals — framing their offering with precision.

3. Is Your LP Pipeline Diversified Enough?

Overconcentration in a handful of LPs or a single geography is a silent risk.

Why this matters:

- A concentrated LP base can be destabilized by redemption cycles, FX swings, or policy shifts.

- In 2025, allocator behavior varies by region:

- North American pensions are leaning into private credit.

- European allocators are emphasizing climate and real assets.

- Middle Eastern family offices are deploying aggressively into AI and infrastructure.

- APAC wealth is flowing into cross-border syndicates.

A GP relying only on domestic institutions risks missing global flows.

What to do: build allocator pipelines with the same discipline you apply to portfolio construction — diversified across region, type, and maturity profile.

The Altss edge: Altss tracks 9,000+ verified family offices globally, refreshed continuously. Managers can map their pipelines across regions and mandates, expanding into allocator pools that align with their thesis but were previously invisible.

4. Are You Building a GP Brand That Survives Diligence?

In 2025, diligence begins before the first Zoom.

Allocators research managers online, reading websites, LinkedIn updates, and public commentary. A weak or outdated digital footprint undermines credibility before a deck is even opened.

Why this matters:

- Allocators want transparency. A missing or outdated online presence signals risk.

- GPs are increasingly judged on clarity of thesis and depth of thought leadership, not just historical IRRs.

What to do:

- Publish insights on your sectors of focus.

- Keep your website updated with team bios, portfolio highlights, and thematic briefs.

- Use LinkedIn to show visibility, not vanity.

The Altss edge: Altss provides the allocator context behind this. By showing which mandates are live, managers can align their external communications to what LPs are actually prioritizing — ensuring public narrative and fundraising strategy reinforce each other.

5. Are You Using Technology to Scale Outreach Intelligently?

Fundraising in 2025 is no longer a craft exercise; it is a process discipline.

Spreadsheets and ad hoc CRMs cannot manage allocator complexity. The volume of LPs, the pace of mandate shifts, and the precision required for outreach all demand structured workflows.

Why this matters:

- Allocators are oversupplied with inbound pitches.

- Generic persistence is ignored; targeted precision is rewarded.

- Without data-driven processes, even strong managers miss their window.

The Altss edge: Altss integrates verified LP contacts, continuously refreshed mandates, and firm histories, enabling managers to operate from a live, outreach-ready platform. This replaces static directories with infrastructure designed specifically for fundraising.

6. Is Your Advisory Network Actually Delivering Capital Access?

Advisors and syndicate partners can provide credibility and warm introductions — but only if they are engaged strategically.

Why this matters:

- Allocators value warm paths. A trusted introduction elevates a GP above generic inbound.

- Many GPs underutilize advisors, treating them as voices, not connectors.

What to do:

- Audit your advisory network. Who has actually delivered introductions in the past?

- Ask for specific warm paths, not vague “support.”

- Measure introductions the same way you track pipeline activity.

The Altss edge: Altss maps advisor–allocator overlaps, showing exactly where warm paths exist to active mandates. This transforms anecdotal networks into evidence-based introductions.

Final Thoughts: Precision Over Volume

Fundraising in 2025 is not about sending more decks. It is about aligning with live allocator mandates, offering co-investment structures as standard, diversifying your LP base, projecting a professional brand, operating with process discipline, and mobilizing networks strategically.

The managers who succeed are those who replace guesswork with evidence.

Altss is built for this environment — continuously refreshed data, live mandate signals, and allocator insights that give GPs an edge at every stage of the raise.

Outlook: 2026 and Beyond

The forces reshaping fundraising in 2025 will only intensify:

- Mandate forecasting will become predictive. Allocators are accelerating cycles. By 2026, managers will need to anticipate mandate pivots before they are announced, using signals like hiring, board changes, or cross-sector reallocations.

- Co-investment performance will be benchmarked. Allocators are formalizing co-investment expectations. By 2026, delivery of co-invest rights will be part of formal review criteria, not informal negotiation.

- Family office syndicates will globalize. Wealth in Asia and the Middle East is moving into cross-border syndicates, especially in AI infrastructure and secondaries. By 2026, syndication will become a standard deployment model.

- Emerging managers will become an allocation category. Institutions are moving from ad hoc exposure to structured emerging manager programs. By 2026, first-time funds will compete within defined buckets, with process discipline as the baseline.

- Continuous refresh will become baseline infrastructure. By 2026, allocators will dismiss static databases entirely. Platforms without live mandate intelligence will be obsolete.

The message is clear: fundraising is no longer about who you know. It is about when you engage, how you align, and whether your process meets institutional expectations.

Altss is not just responding to this shift; it is defining the infrastructure for the next era of allocator intelligence.

About Altss

Altss is the OSINT-powered LP intelligence platform built for fund managers, independent sponsors, and capital-raising professionals.

- Coverage: 9,000+ verified family offices across North America, Europe, APAC, and the Middle East.

- Refresh cadence: profiles updated within ≤30 days; mandate signals refreshed continuously.

- Signals: allocator timing, mandate pivots, co-investment history, warm-path identification.

- Pricing: $15,500/year. No CRM integrations, no CSV exports, no reselling.

FAQ

1. What makes fundraising in 2025 different?

Allocator cycles are shorter and more selective. Outreach must align with live mandates, not generic timing.

2. Why are family offices central to this landscape?

They control $3.6T in discretionary assets and move faster than institutional peers, often leading allocations into new sectors.

3. How does diversification reduce fundraising risk?

Macro volatility — from FX swings to policy shifts — can destabilize concentrated pipelines. Diversification builds resilience.

4. How often does Altss refresh allocator data?

Profiles are refreshed within ≤30 days, with mandate and activity signals updated continuously.

5. How does Altss help lean teams?

At $15,500/year, Altss makes institutional-grade allocator intelligence accessible to emerging managers — enabling them to operate with the same rigor as billion-dollar platforms.

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.