Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Independent sponsors live (and lose) in the gaps—between a signed LOI and a funding clock that doesn’t stop. What kills momentum isn’t a lack of names; it’s latency and doubt:

- Latency: Directories list people who moved months ago. Warm weeks go cold while you re-verify.

- Doubt: Self-reported “mandates” drift. Without proof—filings, hires, vehicles—you’re guessing.

- Deliverability drag: A handful of bounces can bruise domain reputation and slow an entire sprint.

In 2025, winning sponsors pair a sharp thesis with live allocator motion, verified channels, and warm paths—so the first touch is specific, credible, and well-timed.

Altss: OSINT-powered investor intelligence built for sponsors

Altss isn’t a list. It’s a signals layer that shows who’s moving, why now, and how to reach them—with the guardrails sophisticated LPs expect.

What you get today

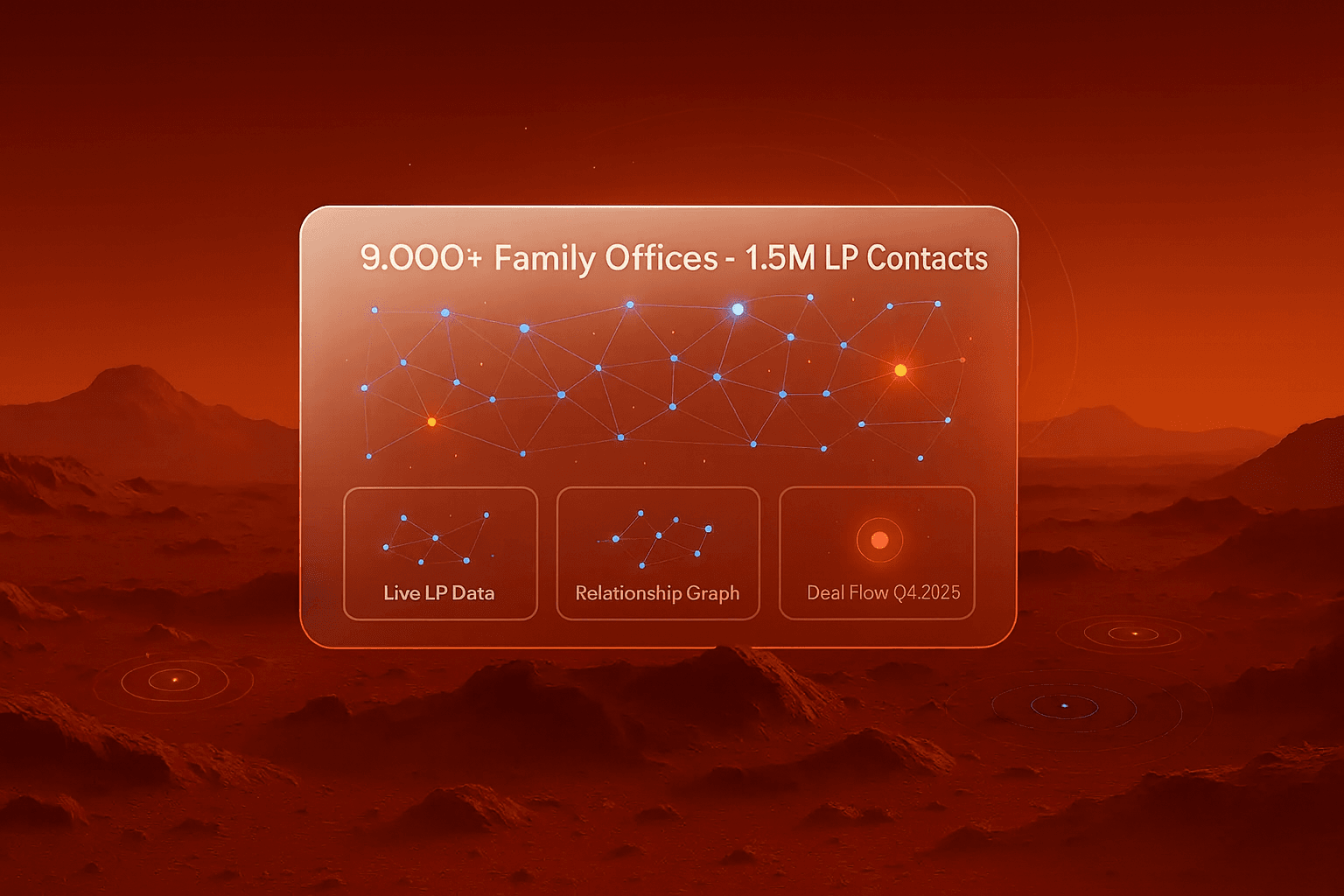

- Deep allocator coverage (refreshed monthly):

9,000+ verified family-office profiles and a broad LP universe across institutions, funds, and HNWIs. Every record is re-verified on a strict ≤30-day cadence. - Live mandate tracking:

Regulatory filings, press, hiring patterns, event presence, and other OSINT streams feed Signal Timelines so you can cite two current reasons why now in a 90-second opener. - Relationship Graph (beta):

Warm paths and alumni linkages surface instantly—turning “who can introduce us?” into a repeatable workflow. - Deliverability SLA:

A 99.7% deliverability commitment backed by record replacement for any bounce. (Inbox outcomes still depend on warm-up, cadence, and content quality.) - Transparent pricing & pilot:

A flat $15,500/year license. A time-boxed free trial lets you test the full platform against your live thesis before you commit.

Why this matters: Sponsors using Altss consistently report cutting LP-sourcing cycles nearly in half—not by blasting more emails, but by sending fewer, better ones to the right people at the right moment.

Your first month on Altss (sprint blueprint)

Week 1 — Frame the thesis and shortlist

Define the deal lane (e.g., $10–40M EBITDA healthcare services, regional roll-up, heavy recurring revenue). Apply 30+ filters (ticket size, geography, sector, GP-less receptiveness, co-invest appetite). Produce a 40–60 name target list with Fit & Timing scores.

Week 2 — Evidence-led first touches

For each LP, attach two live signals from the timeline (vehicle opened, partner hire, recent co-invest, event presence). Send a 90-second opener: why them, why now, your edge, one clear next step.

Week 3 — Trim and fortify

Track replies and objections. Prune non-converting segments. Add a one-pager on your operating thesis (integration plan, cash conversion, downside protection) to strengthen follow-ups.

Week 4 — Convert into meetings

Time nudges around events and committee windows. Offer a short diligence pack (deal memo skeleton, references, timeline) and map warm-path intros through the Relationship Graph.

Sane KPIs

- ≥25% first-meeting rate on qualified targets

- High single- to low double-digit reply rates on evidence-led opens

- Faster diligence because your outreach already answers “why us, why now”

What changes on the ground (three quick vignettes)

1) Healthcare services carve-out

Instead of 200 cold emails, a partner sends 18 messages. Each cites a new partner hire into health services and a vehicle addendum allowing co-invest. Three meetings in 72 hours; one reference intro via an alumni tie the team wouldn’t have found without the graph.

2) Industrial roll-up, Midwest

Signal Timelines flag a family office that exited a related platform last quarter and re-opened for control deals in the region. The opener lands. The sponsor couples the call with a local broker reference; diligence starts the same week.

3) Software add-on

An allocator that historically “passed” on software is back in market after hiring an operating partner from a vertical SaaS exit. Altss surfaces the move; the sponsor threads a verticalization plan. Meeting booked, deck requested.

Coming in Q4 2025: integrated deal sourcing

Your capital is only as good as your pipeline. Altss will extend its OSINT engine to acquisition signals—from expiring credit lines and WARN notices to ownership changes and filings that hint at owner fatigue. Matches route to your saved theses so you can act before a broker blast turns a quiet opportunity into an auction.

Five reasons Altss gives sponsors an edge

Monthly re-verification means you never open with the wrong person.

Deliverability discipline (99.7% SLA with replacement) protects your domain and your brand.

Mandate motion, not static lists—so timing works in your favor.

Warm-path visibility converts “network” from lore into a system.

One flat fee and a free trial—no per-seat guessing, no hidden modules.

FAQs (clear, compliance-ready)

How is the data sourced?

Altss is OSINT-driven and augmented by compliant providers. Contact data passes business-intent screening; opt-out and suppression flows align with GDPR and related standards.

How often is data updated?

Profiles re-verify on a ≤30-day cycle. Signal Timelines update continuously as new public evidence lands.

What exactly does the 99.7% cover?

If an email bounces, Altss replaces the record at no cost. Deliverability still depends on sender behavior (warm-up, frequency, copy).

What’s in the free trial?

Full platform access for a limited period, plus a guided data slice mapped to your live thesis so you can measure meetings booked—not just dashboard views.

Will pricing change when deal sourcing launches?

Sponsors who activate before Q3 2025 lock the $15,500 annual rate for at least 12 months after the deal module goes live.

Key takeaways for independent sponsors

- Static lists slow deals. Signals and verification speed them up.

- OSINT turns public clues into private advantage. You’ll see motion first and write better openers.

- Warm paths beat cold volume. A single well-placed intro can replace fifty emails.

- Governance is part of the pitch. Showing discipline with PII and outreach earns trust before the first diligence call.

Altss bundles LP discovery, relationship mapping, and—soon—deal flow into one platform and one fee. If your next two weeks hinge on real meetings, this is the fastest path from thesis to calendar.

CTA

Book your demo. Start a free trial with data tailored to your next acquisition thesis and measure meetings inside two weeks.

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.