The Best Institutional Investor Database for 2025: Why Altss Is Redefining Fundraising Intelligence

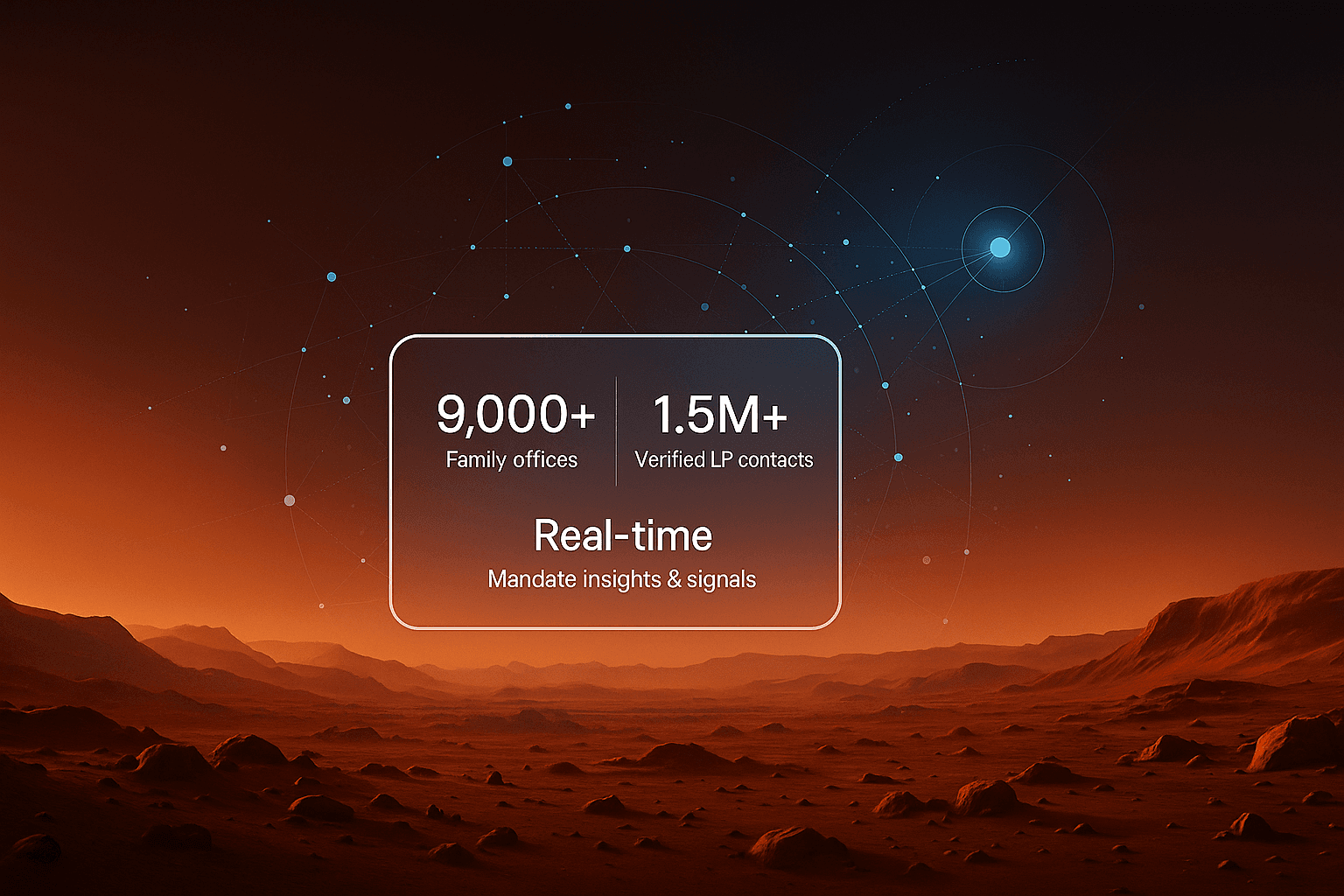

Family offices are reshaping private capital in 2025. Discover why Altss—the institutional investor database built on OSINT—tracks over 9,000 verified family offices and helps fund managers find and convert LPs faster.

Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

The New Frontier of Fundraising Intelligence

Fundraising has always been a data game.

But in 2025, that game has changed entirely.

Legacy investor databases built in the 2000s and 2010s can’t keep up with how capital moves today. Their contact lists go stale within months, and their bulk-email culture has made outreach noisier than ever.

Enter Altss—a new kind of institutional investor database built not for volume but for precision.

Altss was designed by fund managers who’ve collectively raised more than $7 billion across venture, private equity, and real-asset funds. They understood a simple truth: modern fundraising success depends on verified intelligence, not outdated spreadsheets.

The Rise of Family Offices as Global Allocators

The most important story in capital formation today isn’t about big pensions or sovereign funds—it’s about family offices.

A decade ago, family offices were quiet participants in private markets. In 2025, they’re the most agile allocators in the world.

They move faster than institutions, think longer-term than corporates, and are deploying capital into every corner of the alternative asset landscape.

Altss tracks over 9,000 verified family offices across North America, Europe, the Middle East, and Asia. Collectively, these entities manage more than $3.1 trillion in assets—a number projected to exceed $5 trillion by 2030.

The shift isn’t just about scale—it’s about behavior.

Family offices now write direct checks into startups, anchor private credit vehicles, and co-invest alongside institutional LPs. They’re backing energy transition projects, AI infrastructure, and next-generation biotech.

They operate with institutional discipline but retain the freedom to invest on conviction rather than mandate. That flexibility is why so many emerging fund managers now view family offices as their most strategic LPs.

Where Family Office Capital Is Flowing

Altss data shows a sharp rise in allocations toward sectors that blend innovation and durability. Among the fastest-growing themes:

- Artificial Intelligence and Automation: family offices are backing compute infrastructure, AI-native SaaS, and applied robotics.

- Health Tech and Longevity: personalized medicine, biotech platforms, and wellness technology.

- Climate and Energy Transition: renewable infrastructure, battery storage, and carbon reduction systems.

- Private Credit and Asset-Based Lending: yield-oriented vehicles offering downside protection.

- Secondaries and Direct Private Equity: family offices seeking control positions in resilient companies.

Across all these areas, family offices value direct access and data-driven relationships—which is where Altss comes in.

Why Data Became the Ultimate Fundraising Edge

The challenge facing every GP isn’t just who to talk to—it’s knowing when and how to approach them.

Legacy databases were built as static directories. They list names, firms, and stale contact details, leaving fund managers to guess whether an LP is still active, what they’re investing in, or if they’ve moved to a new vehicle.

Altss flipped that model.

Instead of relying on self-submitted data, it uses open-source intelligence (OSINT) to capture allocator activity in real time.

Every record is enriched with signals from filings, press coverage, portfolio updates, event attendance, and professional network changes.

Behind the scenes, Altss combines these public breadcrumbs into verified, live investor profiles.

The result: fund managers get an up-to-date view of who’s active in their sector, what their capital appetite looks like, and how best to reach them.

It’s the kind of insight that can shorten a fundraising cycle from 12 months to six.

How OSINT Rebuilt the Institutional Investor Database

OSINT—open-source intelligence—has long been used in cybersecurity and national security.

Altss brought it to private capital.

Its system continuously monitors thousands of public sources across the web, parsing signals that reveal when an allocator is repositioning, when a partner leaves, or when a family office opens a new mandate.

That process runs 24/7, refreshing data every 30 days.

But intelligence alone isn’t enough—accuracy matters just as much.

Each new lead passes through a human verification layer before being published, ensuring contact information and profiles stay current.

The result is a database that’s both dynamic and dependable—a rare combination in the world of investor data.

Why Fund Managers Are Turning to Altss

Fundraising teams use Altss for three reasons that cut to the core of modern investor relations:

1. Precision Targeting

Altss helps users identify LPs aligned by geography, sector, and stage—eliminating wasted outreach and allowing GPs to focus on investors who already care about their space.

2. Relationship Intelligence

The platform doesn’t just show names; it reveals the connections between them.

Fund managers can see shared board memberships, prior co-investments, and potential warm introduction paths that convert far better than cold outreach.

3. Fresh, Verified Access

Altss maintains a strict 30-day update cadence across all records. Every decision-maker, email, and phone number is verified by both automated pipelines and in-house analysts.

A Platform Built by People Who’ve Raised Capital

Most data products are built by engineers.

Altss was built by people who’ve sat across from LPs and closed commitments.

That insider perspective shaped how the product works.

Instead of focusing on flashy dashboards, Altss emphasizes the three metrics that matter most to GPs: accuracy, depth, and speed.

It’s not about quantity—it’s about actionable insight.

And unlike traditional data vendors that charge per user or per export, Altss keeps pricing transparent: $15,500 per year, flat, with no seat restrictions.

For emerging managers running lean operations, that clarity matters.

Beyond Family Offices: The Next Frontier

While Altss is best known for its family office coverage, the platform’s scope is rapidly expanding.

By the end of 2025, Altss will roll out modules covering:

- Institutional LPs: including endowments, pensions, and sovereign wealth funds.

- GP–LP Connect: a visibility layer enabling live introductions between active fundraisers and allocators.

- Relationship Graphs: mapping every verified link between LPs, GPs, and portfolio companies.

- Interactive Data Rooms: where GPs can share secure materials directly with interested investors.

This evolution positions Altss as more than a data provider—it’s becoming the connective infrastructure for global fundraising.

From Lists to Live Networks

Fund managers often talk about “data” as if it’s static. But real capital networks are constantly moving.

Altss treats investor intelligence as a living system.

Every day, its algorithms detect subtle shifts—new fund formations, mandate updates, team relocations, and family office hires.

Those changes feed back into user dashboards, giving IR teams a live picture of market momentum.

For fund managers raising capital in sectors that evolve fast—AI, climate, defense tech—that real-time visibility can be the difference between being early and being too late.

A Quiet Replacement for Legacy Systems

Behind closed doors, many firms are phasing out their old databases entirely.

What began as experimental trials of Altss has turned into full-scale adoption.

Emerging managers use it to build their first LP pipelines.

Mid-market funds rely on it to expand globally.

And larger PE and VC firms now integrate Altss into their IR stack for mandate tracking and LP updates.

One reason: trust.

Altss doesn’t resell or syndicate its data. It’s designed as a closed ecosystem—built for fundraisers, not list brokers.

That integrity, combined with consistent data quality, has helped it gain traction among allocators themselves, who use the platform to discover new funds that align with their mandates.

Testimonials from the Field

“Altss changed the way we think about fundraising. It feels like a window into the LP universe rather than a spreadsheet.”

— Partner, U.S. Venture Fund

“We found 30 family offices aligned with our energy thesis in under a week. Every contact was verified, every email worked.”

— Managing Director, European Infrastructure Fund

“The platform knows what other databases don’t: that relationships drive returns.”

— Principal, Emerging Manager Program

Verified feedback from fund managers can be found on G2, where Altss consistently earns top marks for accuracy, usability, and support.

Why Intelligence Is Now a Fundraising Strategy

For the first time, fundraising strategy is measurable.

It’s no longer about intuition—it’s about visibility.

A fund manager can now track which allocators are active, when mandates change, and how deal flow patterns evolve.

Those who rely on static lists will keep guessing.

Those using dynamic intelligence will stay ahead of the curve.

Altss gives fundraisers a way to see beyond the noise—to operate with the same precision as the allocators they’re pitching.

That’s not just an advantage. It’s becoming a requirement.

Final Word

The future of private capital belongs to the data-literate.

As family offices and institutional investors grow more sophisticated, fund managers need tools that match their pace.

Altss delivers that edge.

It’s more than a database—it’s an evolving intelligence platform that reflects how real fundraising happens now: through relationships, timing, and data that doesn’t go stale.

For fund managers serious about building lasting LP relationships, this is where the next generation of capital formation begins.

Altss — Raising the Standard for Fundraising Intelligence

Build smarter LP relationships. Request a Demo or Read Verified Reviews on G2

Frequently Asked Questions

1. What makes Altss different from other investor databases?

Altss isn’t a recycled contact list. It’s a live, OSINT-powered investor intelligence platform refreshed every 30 days and verified by analysts. It delivers real-time signals and relationship data across 9,000+ family offices.

2. How many family offices does Altss cover?

As of 2025, Altss tracks more than 9,000 verified family offices globally, including single-family and multi-family structures with direct investment mandates.

3. Does Altss also cover institutional LPs?

Yes. A new institutional LP module covering endowments, pensions, and sovereign wealth funds is scheduled for rollout in early 2026.

4. How accurate is the data?

Altss maintains one of the lowest bounce rates in the industry thanks to continuous OSINT enrichment and human verification. All contacts and decision-makers are validated every month.

5. Who uses Altss?

Fund managers across venture capital, private equity, private credit, and real estate; family offices conducting co-investments; and advisory firms mapping allocator relationships.

6. How much does Altss cost?

Altss offers a flat annual subscription of $15,500 per year, with no per-seat limits or hidden fees.

7. Can fund managers request custom research?

Yes. Altss users can request bespoke LP lists tailored to geography, stage, and sector—curated directly by the research team.

8. Where can I read independent reviews?

Visit G2 to see verified user experiences from fund managers and investors who rely on Altss for daily LP intelligence.

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.