Guide to Fundraising in 2025: Five Trends Every Fund Manager Should Know

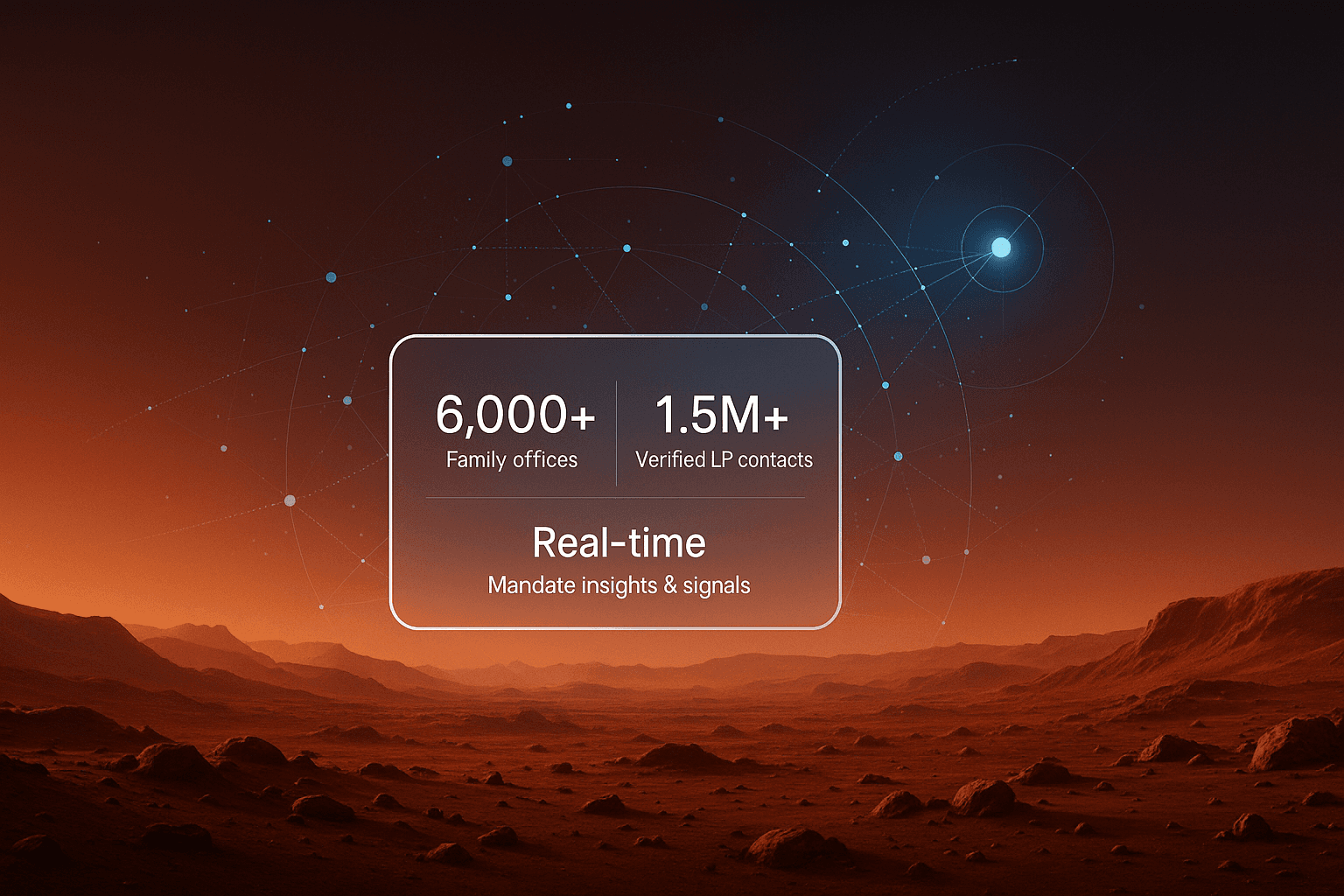

Fundraising in 2025 is defined by precision, compliance, and LP selectivity. This in-depth guide outlines five trends shaping the alternative asset fundraising landscape: AI-driven allocator intelligence, the rise of thematic LP allocations, structured capital vehicles like DAFs and SPVs, tighter regulatory oversight, and the importance of LP retention. It shows how fund managers, private equity firms, and independent sponsors can adapt—and why Altss outperforms legacy databases by surfacing real-time allocator signals, mapping 6,000+ family offices, and embedding OSINT safeguards to convert data into allocations.

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Fundraising in 2025 is moving faster and changing more fundamentally than at any point in the last decade. Technology is reshaping how GPs engage with LPs, family offices are growing as a share of commitments, regulators are raising the bar on transparency, and macro headwinds are making investors choosier.

For general partners, private equity firms, independent sponsors, and emerging managers, understanding these shifts is not optional. It is the difference between a fund that closes quickly and one that lingers in market.

This guide explores five critical fundraising trends in 2025 and offers practical strategies to adapt. Along the way, we highlight why Altss—the only OSINT-powered LP intelligence platform built for allocator signals, family-office depth, and compliance—provides the edge GPs need to convert relationships into allocations.

1. AI for Fundraising Intelligence—With LP Privacy in Mind

Artificial intelligence is no longer just an accessory in fundraising. In 2025, AI is central to how managers source, segment, and engage LPs. But the conversation has moved beyond AI-written emails or pitch-deck summarizers. The real shift is in allocator intelligence.

Tools built on OSINT, large language models, and real-time mandate tracking are changing how GPs build their pipelines. Instead of guessing which LPs are active, managers can now detect intent signals in public filings, regulatory disclosures, board changes, conference agendas, and media coverage.

The challenge is that AI must be paired with compliance. LPs are rightly concerned about privacy and data integrity. Misusing scraped information or failing to verify accuracy can damage reputations and derail fundraising.

What to Do

- Treat AI as an augmentation layer, not a replacement for relationship building. Use it to prioritize and time outreach, not to replace judgment.

- Work with platforms like Altss that integrate allocator social listening with entity resolution and deliverability guardrails. Every contact is verified, and every signal is tied to a real entity, reducing noise.

- Build internal governance frameworks for AI use: document what tools you deploy, how data is verified, and how privacy is protected. LPs increasingly ask these questions in due diligence.

By 2025, AI is not the differentiator—it is the baseline. The differentiator is responsible AI, deployed with compliance and transparency at its core.

2. The Rise of Thematic LP Allocations

The generalist pitch is dying. LPs in 2025 are consolidating into fewer, higher-conviction themes. Instead of scattering capital across broad portfolios, they are concentrating in areas where structural drivers are strongest.

The data confirms this shift. Dealroom’s 2025 European Deep Tech Report shows that while generalist VC funding declined almost 45 percent since 2021, deeptech only fell by about 28 percent. Climate tech and energy transition investment held steady despite broader volatility. Defence and dual-use technologies, meanwhile, saw sharp increases, with FT reporting that European defence-tech investment rose to €1.4 billion in just the first seven months of 2025.

Family offices are also leaning into themes. The HSBC European Family Office Report 2024 found that on average, family offices now allocate 24 percent of portfolios to private equity and venture capital, with a growing preference for thematic allocations in AI, infrastructure, and impact.

What to Do

- Position your fund with a clear thematic thesis. LPs want to know not just what you invest in, but why now, and how your sector focus aligns with macro or policy tailwinds.

- Avoid shallow buzzwords. LPs have seen too many decks with “AI” pasted on top. Instead, show defensibility—unique distribution, proprietary datasets, regulatory catalysts.

- On Altss, filter LPs by thematic alignment. If your focus is AI infrastructure or climate transition, you can surface the LPs with live mandates in those sectors. That shifts fundraising from cold outreach to mandate-driven targeting.

Thematic capital is not niche—it is the mainstream. GPs who fail to specialize risk being filtered out of LP pipelines before the first call.

3. DAFs and Structured Capital in GP/LP Relationships

Donor-Advised Funds (DAFs), family offices, and private wealth platforms are rewriting the mechanics of capital entry. Instead of traditional single-commitment fund subscriptions, allocators are increasingly using structured vehicles: SPVs, feeder funds, co-investment syndicates, and pledge agreements.

This matters for two reasons. First, it increases flexibility—smaller LPs can gain exposure to funds they could not access directly. Second, it complicates fundraising. GPs must now understand the nuances of structured capital, from tax implications to reporting.

Family offices in particular are using these structures to access venture and private equity. According to Invest Europe’s 2024 CEE report, private investors and family offices represented nearly 19 percent of total fundraising in the region, with many entering through hybrid structures.

What to Do

- Build familiarity with DAFs, feeder funds, and pledge arrangements. Even if your fund has not accepted them before, be prepared to explain your position.

- Integrate structured capital into your GP toolkit. A willingness to accommodate flexible entry points can win mandates.

- Use Altss to track not just LP entities but also their preferred structures. The platform monitors DAFs, hybrid vehicles, and co-investment syndicates, giving GPs clarity on how capital is likely to arrive.

In 2025, structured capital is not an edge case. It is a mainstream feature of GP/LP relationships.

4. Policy Headwinds and Regulatory Watch

If AI and themes are the “pull” forces in fundraising, regulation is the “push.” The compliance bar has risen globally.

In the U.S., the SEC’s new private fund rules have increased disclosure requirements and imposed restrictions on preferential treatment. In Europe, SFDR Article 9 sustainability classifications have become baseline, while new AI ethics and cybersecurity standards are finding their way into LP questionnaires.

The effect is straightforward: compliance is now a gating factor in fundraising. LPs will not allocate if they cannot trust your governance.

What to Do

- Stay ahead of the rules. Subscribe to LP compliance feeds, join webinars, and engage your legal advisors before rules become binding.

- Treat compliance as a front-page item in your deck, not an appendix. LPs want to see that you view governance as core.

- Leverage Altss’s integration with regulatory filings. The platform tracks firm registration changes, compliance signals, and filing updates, giving GPs early insight into how LPs are moving under new rules.

In 2025, compliance is not a cost center—it is a competitive advantage. GPs who can show proactive governance earn trust and close faster.

5. LP Retention and Relationship Engineering

Fundraising headlines often focus on new LP wins. But the reality is that retention drives fund durability. A strong Fund II, III, or IV is built on re-ups, not fresh names.

Retention, however, is harder than it used to be. LPs demand continuous updates, impact metrics, and transparency. They expect to be treated as long-term partners, not just check writers.

The EIF’s 2024 VC survey found that LPs value frequent, clear communication as a key factor in manager selection and re-up decisions. Poor communication is one of the top reasons LPs churn.

What to Do

- Treat LPs like customers. Map their history, track their preferences, and tailor communication accordingly.

- Use Altss to monitor LP news, role changes, and past commitments. That allows you to engage with context—referencing their history with your fund, their sector focus, or recent mandate changes.

- Build a cadence of proactive updates: monthly notes, quarterly dashboards, and annual deep-dives. Surprises erode trust; transparency builds it.

In 2025, LP retention is engineered through data. The managers who institutionalize communication outperform those who improvise it.

Why Altss Wins in This Landscape

Across all five trends—AI, thematic capital, structured vehicles, regulation, and retention—Altss emerges as the decisive infrastructure layer.

- Real-time allocator signals. Unlike static directories such as Preqin, PitchBook, or Dakota, Altss continuously listens across filings, media, and events, resolving signals to entities. GPs know not just who LPs are, but who is active this quarter.

- Family-office depth. Family offices now represent more than 20 percent of European VC commitments, but legacy platforms under-index them. Altss tracks over 6,000+ globally, with 1,100+ allocating actively in Europe.

- OSINT compliance. Defence, dual-use, and AI ethics risk are growing. Altss integrates OSINT safeguards, flagging sanction-linked LPs or politically exposed persons, protecting reputation.

- Deliverability and warm paths. Altss doesn’t just list LPs—it verifies principal-level routes and maps warm introductions, turning data into booked meetings.

- Integrated IR layer. From dashboards to mandate histories, Altss doubles as an IR system, aligning perfectly with LP expectations for transparency.

A London GP described the difference: “We switched from a legacy database to Altss and uncovered 42 stealth family-office investors in six weeks. No other platform got us there.”

In 2025, the edge is not breadth of coverage. It is precision of signal. That is why Altss wins.

Final Thoughts

Fundraising in 2025 is no longer a numbers game. It is an orchestration of data science, thematic clarity, regulatory compliance, and relationship management.

- AI must be harnessed responsibly.

- Thematic allocations must be proven, not postured.

- Structured capital must be accommodated with fluency.

- Compliance must be demonstrated proactively.

- LP retention must be engineered with data.

For managers who adapt, the reward is not just closing their current fund but building durable relationships that compound over multiple vintages.

Platforms like Altss make that adaptation possible—transforming LP intelligence from static lists into actionable signals, verified contacts, and compliance-safe pathways. In a year defined by selectivity and precision, Altss is the fundraising infrastructure layer every GP should build on.

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.