Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

2025 isn’t the year venture capital dies. It’s the year it disciplines.

After a decade of boom-bust cycles, the private market has entered its most strategic phase. Valuations are recalibrated. LPs are cautious. Founders can’t raise on narratives alone.

But this isn’t a closed market—it’s a filtered one. And for those who understand the shift, 2025 may be the best fundraising window since 2017.

This guide breaks down the trends redefining capital formation—and why data-first platforms like Altss are becoming indispensable for tracking who’s raising, deploying, and winning.

Market Context: This Is a Correction—Not a Collapse

Global VC funding fell 15% YoY in 2024, but top-quartile funds still outperformed benchmarks (Crunchbase 2024 Review). LPs aren’t fleeing—they’re reallocating to firms with realized DPI, not IRR hypotheticals.

Rates remain high. Liquidity is uneven. But capital isn’t gone. It’s just more selective.

“Capital is cautious, not absent. It’s going where fundamentals are defensible and exits feel real.”

1. Valuations Are Normalizing—But Not Everywhere

Median Series A and B valuations are down 30–50% from 2021 peaks (Carta). But AI and climate tech are still commanding premiums—when backed by fundamentals.

Sectors still getting full-throttle VC allocation:

- Proprietary AI infrastructure

- Energy optimization, carbon removal

- Vertical SaaS with true GTM traction

Altss Insight: Track over 8,000 private VC deals by stage, sector, and valuation delta. Benchmark your next round against fund-level DPI and sector allocation velocity.

2. AI Dominates—but Jargon Is Getting Priced Out

AI accounted for nearly 30% of global VC dollars in late 2024 (PitchBook). But we’ve moved from narrative hype to utility-grade demand.

What investors now require:

- Models trained on proprietary data

- Tangible workflow compression or new revenue unlocks

- Clear technical articulation—without jargon

“Saying ‘we use AI’ is like saying ‘we use the internet’ in 2001. It doesn’t move capital.”

Altss Data: Top-performing funds are concentrating on AI applications in underwriting, biotech simulation, and robotics—not just UX wrappers for LLMs.

3. The Unicorn Reset Is Real

As of Q1 2025, there are over 1,200 unicorns—but many face internal repricing, down rounds, or silent shutdowns.

Investors no longer accept valuation as a proxy for success. They want:

- Net revenue retention (NRR)

- Contribution margin path to breakeven

- ARR-to-headcount efficiency

Altss Signal: 19% of unicorns raised flat or down rounds since 2023. Altss flags which are still scaling—and which GPs are quietly rotating out.

4. Exit Pipelines Are Reopening (Slowly)

The IPO window is no longer welded shut. Public market activity in AI, fintech, and biotech has reignited GP and LP optimism.

- Liquidity is recycling into new funds

- GPs are prepping Series C–D companies for exit

- Strategic M&A activity is rising, especially in infra and AI adjacencies

“Exits don’t need to be explosive—they just need to be believable.”

Altss Trendline: Track funds targeting liquidity events and LP reallocation patterns. Monitor exit prep signals by firm, vintage, or sector.

5. Private Capital Is Selective—but Still Flowing

LPs are actively investing—but with sharper filters:

- Prioritization of GPs with DPI visibility

- Tactical co-investments over blind pools

- Preference for sector-focused mandates

For founders, this translates to:

- Measurable GTM

- Controlled burn

- Clarity over charisma

“It’s no longer ‘are you fundable?’ It’s ‘are you legible to a thesis-driven allocator?’”

Altss Use Case: Founders use Altss to identify GPs by check size, stage, and live mandate—targeting precision over volume.

The 2025 Startup Playbook

What works now isn’t volume—it’s signal alignment. Winning founders are:

- Prioritizing capital efficiency (burn multiple, CAC payback, margin trajectory)

- Building with defensibility (data moats, B2B lock-in, platform adjacency)

- Getting exit-aligned early (shape cap table and metrics for M&A/IPO readiness)

- Using real-time investor intelligence, not pitch deck guesswork

Why Altss Is Essential in 2025

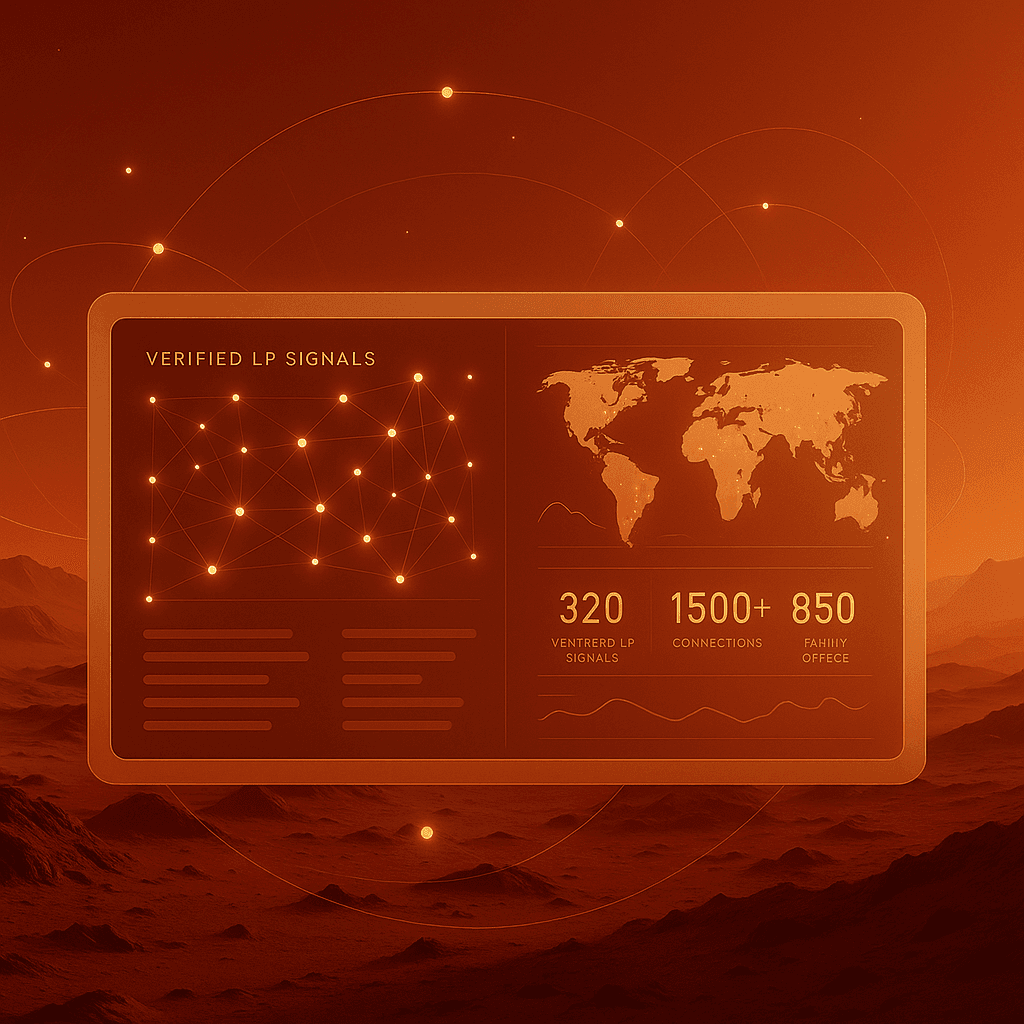

This market rewards sharp timing, not surface-level signals. Altss equips IR teams, GPs, and founders with actionable market intelligence:

- Track LP reallocation and fund momentum

- Surface active GPs and capital flows by sector

- Benchmark fundraises and exits against real-time deployment data

“Altss doesn’t just show who raised. It shows who’s deploying, which LPs are rotating, and what thesis they’re backing.”

Ready to Raise in 2025?

Precision beats persuasion. In a market where every round is scrutinized, Altss helps you lead with data, not guesswork.

📍 Explore live fundraising signals: Altss.com

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.