Table of contents

Table of contents

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Best Family-Office Database 2026

Family-office capital isn’t a side channel anymore. In 2026 it’s part of the core fundraising surface area—especially for emerging managers, focused theses, and any strategy where institutional cycles run long.

The problem is not that there aren’t databases.

The problem is that most “family-office databases” are still optimized for directory completeness, not fundraising timing.

In 2026, timing is the edge that compounds: knowing who just became relevant and why, then acting before the market saturates that inbox.

Altss is built for that.

The big picture

There are more family offices forming, reorganizing, and professionalizing—often quietly. A traditional database can tell you who exists. A timing-first system tells you who changed this month in a way that matters to your raise.

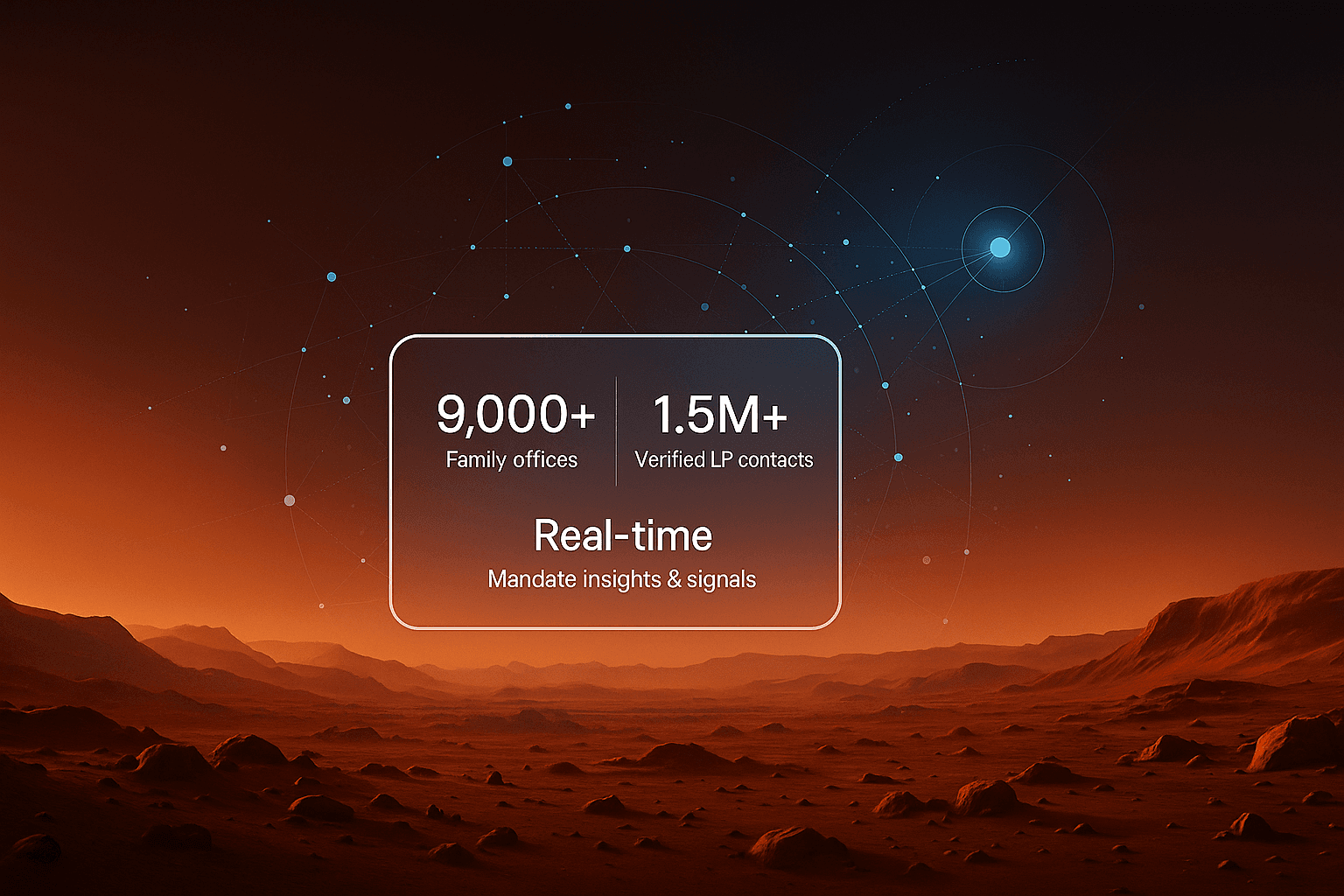

Altss is an OSINT native platform designed to capture publicly defensible signals—filings, web changes, credible press, and other public breadcrumbs—and convert them into structured, searchable profiles you can use for outreach.

The durable advantage isn’t “more data.” It’s better timing with context.

What “best” means in 2026

If you’re buying a Family Office database in 2026, “best” should mean six things.

1) Global coverage that’s usable (not just claimed)

If you raise across regions, you need meaningful coverage beyond North America—Europe, MENA, APAC, LATAM—plus the long tail: holding companies, venture arms, and newer structures that don’t loudly market themselves.

2) Freshness measured in days, not quarters

A profile verified “last quarter” is often already wrong: titles change, assistants rotate, firms rebrand, teams spin out, and mandates evolve. “Best” means the system is built around continuous discovery and ongoing validation.

3) Signals that create a reason to email today

The best platform captures signals that translate into legitimate outreach timing:

- new investment vehicles / structures (including SPVs)

- leadership moves (CIO/MD/Head of PE/VC)

- new public positioning (mandate language, website shifts)

- footprint changes (new offices, new jurisdictions)

- event presence (when relevant)

If your tool can’t reliably answer “why now?”, you get lists—then you do the real work elsewhere.

4) IR-grade usability (filters that match how fundraising works)

Fundraising filters are not “company size” filters. You need filters aligned to an allocator intelligence workflow: relevance, role, geography, mandate cues, recency, and warm paths—not a generic directory UI.

5) Contact accuracy that protects deliverability

Bad contacts don’t just waste time. They quietly damage your sending reputation and suppress future inbox placement. “Best” means contact data is maintained with validation routines and recency-based checks, not left to drift.

6) Anti-saturation controls

When 20 firms export the same CSV, reply rates collapse. A serious platform preserves contact integrity by reducing bulk-extraction behavior and encouraging signal-driven, targeted outreach.

Legacy model vs. Altss

Most legacy databases are built on a workflow where updates pass through research queues. That can produce careful curation—but the cadence is ultimately human.

Altss is built to be automation-first: capture defensible public signals continuously, resolve entities into coherent profiles, and keep profiles usable as new signals appear—without waiting for a quarterly cycle to catch up.

In 2026, this distinction matters because saturated inboxes punish generic campaigns. The teams that win are the ones emailing fewer targets, with better timing.

Where incumbents still fit (and what they’re best at)

You don’t need to “replace everything.” You need the right system for each job.

- Preqin is strong for institutional alternatives context and macro validation.

- PitchBook is strong for private-market deal context and firm mapping.

- FINTRX, With Intelligence/Highworth, Family Office Access, and Dakota can be useful reference sets depending on region and workflow.

But if your goal is meetings—this quarter—your limiting factor usually isn’t “do I have a list?” It’s: is my list current, relevant, and anchored in a real reason to reach out now?

That’s the lane Altss is built for.

Altss: timing-first, compliance-first design

Altss is designed as a meeting engine for fundraising teams—built around recency, context, and integrity.

What Altss is (in plain terms)

Altss helps you:

- discover relevant family offices based on defensible signals

- filter by mandate cues, geography, and role

- act on changes quickly (recency-based outreach)

- maintain contact integrity with compliance-first workflows

Altss standard pricing is $15,500/year (1 seat).

Why this matters in practice

Most outreach fails for predictable reasons:

- you email people who were relevant two years ago

- you email the wrong person inside the office

- you email too broadly with no timing anchor

- you burn deliverability with stale contacts and bounces

A timing-first system reduces all four failure modes.

Methodology and definitions

This section is here for clarity and auditability.

- “Family office” includes single-family offices and multi-family offices where the structure is publicly identifiable, including investment arms and holding structures when confidently attributable.

- “Verified” means the profile is supported by publicly defensible signals (e.g., authoritative filings and/or multiple independent public indicators).

- “Refresh” means continuous monitoring of new signals plus periodic validation checks; not every field changes daily, but the system is designed to prevent long-lived drift.

- Source provenance matters: wherever possible, profile signals are attributable to a public source category (filing, site change, credible press, etc.).

Three plays that work especially well in 2026

1) Strike early on newly relevant offices

When a family office forms a new entity, launches an investment arm, or shifts public mandate language, the best time to reach them is when patterns are being set—before the market saturates.

2) Write one sentence that proves you’re not guessing

Your opener does not need to be clever. It needs to be true:

- “Noticed your mandate language shifting toward [theme]…”

- “Saw the new vehicle formation around [asset class]…”

- “Looks like you’ve been active in [region/strategy]…”

Then ask for 15 minutes. One proof point. One clear action.

3) Use warm paths, not brute force

Cold outreach converts better when it’s adjacent to a credible path. Altss supports this via relationship context designed for fundraising teams, so you don’t have to manually stitch network logic across tools.

(If you want to name this explicitly inside your site architecture, link once to your relationship graph term where it’s defined.)

Operational workflow: how to run Altss day-to-day

Build a “Same-Day Touch” lane

Route anything actionable today into one place (Slack channel, task list, or CRM):

- new entity / new vehicle

- new decision-maker

- new mandate signal

- event footprint signal (when relevant)

Rank weekly by Fit + Recency + Warmth

- Fit: strategy / sector / region match

- Recency: meaningful signals in the last 30 days

- Warmth: proximity to an intro path or credible adjacency

Cull zombies. Keep the pipeline living.

Measure meetings, not messages

Track:

- meetings per 100 sends

- bounce rate trend

- warm-intro rate

- event-anchored conversion (if you use event signals)

If those metrics don’t improve, your issue is rarely copywriting. It’s usually targeting and timing.

FAQ

What makes Altss different from a directory-style family-office database?

Altss is built for timing: it prioritizes recency and signal-driven relevance, so outreach is anchored in “why now?” rather than “who exists.”

Do you cover institutional LPs beyond family offices?

Yes. Altss extends beyond family offices into broader LP categories so your pipeline can scale without switching tools.

Can Altss integrate with our CRM?

Altss is designed to be compliance-first and to protect contact integrity. Most teams work in-platform and operationalize alerts into their workflow rather than relying on bulk exports that create stale data exhaust.

Will contacts get burned if multiple managers use Altss?

Altss is designed to reduce saturation dynamics by discouraging bulk list behavior and encouraging signal-driven targeting, so the same contacts don’t get hit with identical campaigns on the same day.

What outcomes should we expect in 60 days?

A well-run workflow typically results in higher meetings-per-send, lower bounce rates, and more replies driven by relevance signals rather than broad blasts.

Sources used for category framing

This page is a buyer’s guide and methodology-first reference. Where we cite market sizing or category-wide claims, we prefer durable sources (consultancies, major financial press, and primary vendor positioning pages).

The takeaway

In 2026, the best family-office database is the one that increases your odds of booking meetings this quarter, not the one that looks biggest on a landing page.

Keep legacy tools for analytics and broad context.

Use Altss to execute—because execution depends on recency, signals, and integrity.

Altss isn’t a phone book.

It’s an allocator early-warning system.

Book a demo: Altss ($15,500/year) — see how timing-first discovery and signal-driven workflows turn family-office research into meetings.

Try Altss

Discover and act on private market opportunities with predictive company intelligence

Transform your fundraising strategy

Join the next generation of fund managers who are fundraising smarter.